Structuring Early Retirement Income to Pay 0% in Capital Gains Taxes

Introduction

Early retirement can be an exciting yet scary time - you are adjusting to days without the structure of work, transitioning from accumulating assets to withdrawing from them, and building what might feel like a new life. One overlooked area of early retirement planning is tax planning, especially with regard to capital gains taxes.

Understanding Capital Gains Taxes

Basic Facts

- When you sell an asset (such as a stock, mutual fund, or property), you pay taxes on any gain realized.

- The gain (or loss) is calculated with the following basic formula:

Sales Price - Cost Basis = Gain (Loss) - Cost basis is the amount you paid for the asset plus any improvements (in the case of real estate) or ongoing investments such reinvested dividends.

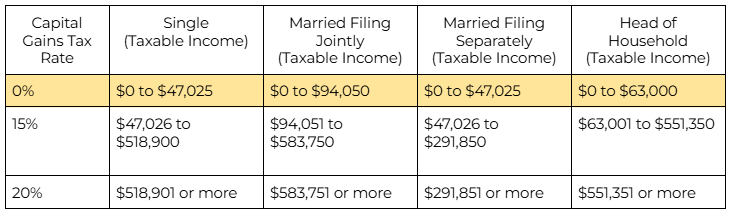

- For assets held less than 1 year, the capital gains tax rate is the same as your ordinary income tax rate. However, for assets held greater than 1 year, you can use the long-term capital gain tax rates which are lower. The rates are 0%, 15%, and 20%. Below is a chart showing capital gain tax rates for 2024.

So, how can you pay 0% federal taxes on realized capital gains?

Well, the first step is controlling your income in early retirement.

Example: John and Sarah

- John and Sarah are both 65 and it’s their first year of retirement. They do not have a pension, are not taking Social Security, and have no earned income. They have $2,000 in interest income and $20,000 in dividend income ($18,000 of that are qualified dividends taxed at the capital gains rate).

- They have $350,000 in long-term unrealized gains that they could harvest in their Trust account. John and Sarah are not taking any short-term capital gains.

- They both have IRAs but are not yet subject to Required Minimum Distributions.

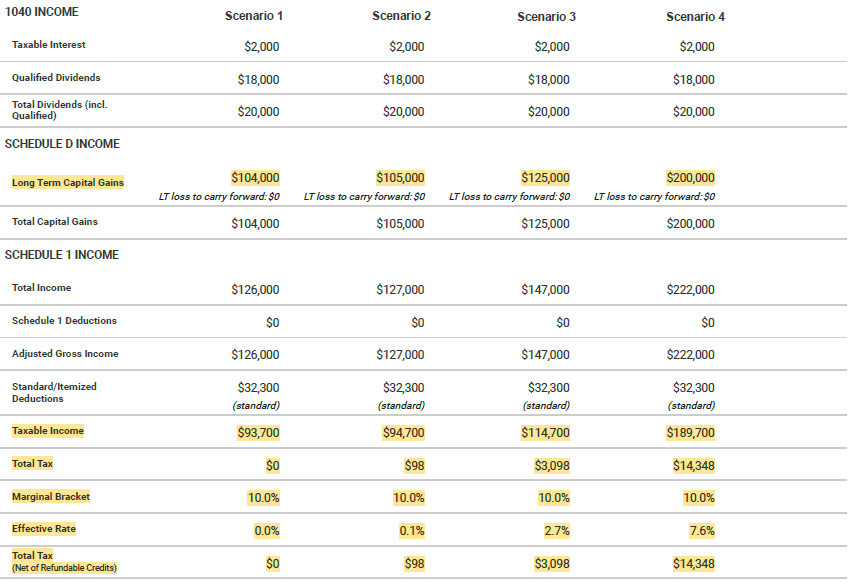

- Below are 4 tax scenarios for 2024. The only change in each scenario is the amount of long-term capital gains realized.

Note: Calculations are for example only. Your specific tax plan should be reviewed by a tax professional.

Scenario 1 shows the maximum amount of long-term capital gains John & Sarah can harvest while keeping their tax rate at 0%. In this scenario, they can harvest $104,000 in long-term capital gains!

Scenario 2 shows the threshold where they start paying taxes on their income. In this scenario, going from $104,000 to $105,000 in realized long-term capital gains results in a total federal income tax of $98.

Scenario 3 shows how John and Sarah’s taxes increase while taking $125,000 in long-term capital gains. However, their effective tax rate (total tax divided by taxable income) remains low at only 2.7%.

Scenario 4 assumes they realize $200,000 in long-term capital gains which results in an effective tax rate of 7.6%.

It’s easy to see Scenario 1 and think that’s the best option since it results in $0 taxes. However, the best option for John and Sarah may be Scenario 4, which gives them the opportunity to harvest a good chunk of long-term gains while still paying well under the 15% capital gains tax rate.

Planning Steps

- Assess Your Situation

- Calculate your potential capital gains tax liability including state and local taxes

- Consider future growth of assets and any benefits from realizing gains now

- Evaluate tax location strategies when rebalancing investment accounts and putting income-producing investment assets in tax-deferred accounts such as Traditional IRAs

- Consult Professionals

- Work with financial advisors and tax professionals familiar with your income and tax planning needs

- Regular Review

- Update your plan when your financial situation evolves

- Consider Your Goals

- Balance tax minimization with your overall retirement planning objectives

Conclusion

Early retirement is a great time to be intentional about your retirement income strategy and possible tax advantages to keep your income low. However, we believe it’s important to remember that what looks optimal on paper may not be what is optimal for your family. Working through different scenarios with a trusted advisor can help you make the best decision for your family.

Schedule a free consultation with our team of tax-savvy and experienced retirement experts. We'll help you address all your concerns and develop a strategy that meets your financial goals, aligns with your values, and secures your legacy.

Schedule Your Free Consultation Now

Remember, at Trailhead Planners, we believe that holistic financial planning is about more than just money - it's about legacy, fulfillment, and values. Let us help you build the retirement you've always dreamed of.